Thai IPO frenzy drives record-breaking first half, the busiest year seen

Thai IPO frenzy drives record-breaking first half, the busiest year seen

วันที่นำเข้าข้อมูล 14 Sep 2021

วันที่ปรับปรุงข้อมูล 29 Nov 2022

Thailand’s IPO market showed a continued growth momentum in the first half of this year, in terms of funds raised and market capitalization.

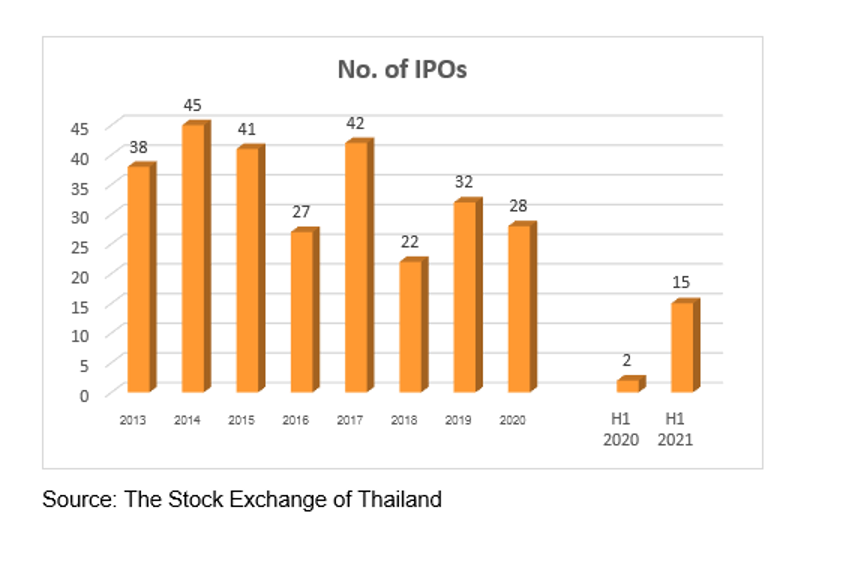

An aggregate offering size and market capitalization of 15 Thai companies through stock market listings in the first half of 2021 was larger than in the same period of any year. The new records are a proof that the Thai bourse remains the pivotal fund-raising venue for local companies and should remain so thanks to the strong appetite to tap into the Thai stock market’s depth of investor base.

In 2020, 28 companies’ total offering size was tuned at USD 5.49 billion (THB 164.67 billion) through listings on The Stock Exchange of Thailand (SET) and Market for Alternative Investment (mai), with a record-breaking market capitalization of USD 18.50 billion (THB 555.3 billion) even when Thailand was shrouded by economic difficulties. By IPO market capitalization, Thailand was also the world’s eighth biggest listing venue and topped its ASEAN peers in 2020.

The positive sentiment continued in the first half of this year. According to SET’s data, 15 new IPOs were launched including PTT Oil & Retail Business pcl (OR), Ngern Tid Lor pcl (TIDLOR) and Don Muang Tollway pcl (DMT), with the total offering size of USD 3.18 billion (THB 101.78 billion) that smashed the previous record of USD 2.84 billion (THB 85.3 billion) in the first half of 2020. The three Thai newly listed companies were also in the top five IPO deals in ASEAN.

Aside, the growth momentum was witnessed in terms of IPO market capitalization. In the first half of 2021, the IPO market capitalization of the 15 new listings was as high as USD 10.67 billion (THB 341.98 billion), pushing Thailand on top of the ASEAN IPO list over the period. In the same period last year, only 2 companies made a debut in the stock market, including the country’s largest-ever IPO deal by offering size, Central Retail Corporation pcl (CRC) as many companies pushed back their listing plans following the first wave of COVID-19 spread. The IPO size of Thailand’s largest retailer and the retail arm of Central Group amounted to USD 2.60 billion (THB 78.12 billion).

The record-setting first-half has reflected that the Thai stock market has been the pivotal fund-raising venue for Thailand’s economy. It is in line with global phenomenon when low interest rates are kept low and major economies like the United States and China show signs of recovery from the COVID-19 pandemic. A research by PwC titled “Global IPO Watch” reported global IPO issuance in the first quarter alone was USD 202.9 billion from 727 IPOs, fueled by the significant activity in the United States.

The new records also indicate that Thai companies’ appetite to tap into the Thai stock market’s depth of investor base remains strong.

The 15 new listings were well diversified across 8 industry groups with Consumer Products and Property & Construction taking the lead at three listings each. Other industry groups are Financials, Services and Technology at 2 each, and Agro & Food Industry, Industrials and Resources at one each.

Needless to say, after the COVID-19 pandemic upended the global economy including Thailand, Thai business operators and their counterparts elsewhere are busy seeking listing to strengthen Their balance sheets and prepare for business expansion as the global economic pickup is gaining speed.

The active IPO market in Thailand is also attributable to the national economic policies.

Over the past few years, the Thai government has introduced many policies to boost Thailand’s domestic consumption and supported many new businesses in new economy; for example, 12 new S-curve industries, and Startup/SME businesses related to new normal lifestyle. Once these industries gain strength, more IPO cases are expected.

Meanwhile, SET amended listing criteria by market capitalization test, effective in May 2021, as part of SET’s regulatory reform plan. The amendment was aimed at better facilitating the fund raising of companies engaged in target industries including digital, biotechnology, nanotechnology, smart electronics, and next-generation automotive.

Under the amendment, SET scrapped the profitability requirement for companies in the target industries that are granted the Board of Investment’s investment promotion certificates and show at least USD 234 million (THB 7.5 billion) in market capitalization. The amendment is expected to enable companies with growth potential to easier access funding in the Thai capital market.

The outlook is positive for the continuation of growth momentum in the rest of the year. With more than 20 securities in the IPO pipeline, the Thai bourse is set to record another best IPO year in 2021.

In terms of IPO market capitalization, the six-month tally already surpassed SET group’s full-year target of USD 7.80 billion (THB 250 billion). It is interesting to see if the full-year figures will beat the historical high of USD 18.5 billion (THB 555.3 billion) recorded in 2020. Thailand’s IPO market capitalization was on top of ASEAN list for the second year running and the world’s eighth largest in 2020 compared to the 9th place in 2019.

Source: https://www.thailandnow.in.th/business-investment/thai-ipo-frenzy-drives-record-breaking-first-half-the-busiest-year-seen/

สถานเอกอัครราชทูต ณ กรุงดิลี